South Australian Superannuation Board Annual Report 2023-24

2023‑24 Annual Report: South Australian Superannuation Board

Section Heading

Annual Report: online version

-

Covering letter

To: Hon. Stephen Mullighan MP, Treasurer

Dear Treasurer

On behalf of the South Australian Superannuation Board, I am pleased to present the Annual Report for the financial year ended 30 June 2024.

The Report is submitted for your information and presentation to Parliament in accordance with the requirements of section 21 and schedule 3 (section 10) of the Superannuation Act 1988 and section 16 of the Southern State Superannuation Act 2009 and Premier and Cabinet Circular PC013 Annual Reporting.

This Report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the South Australian Superannuation Board by:

June Roache

Presiding MemberDate

25/09/2024 -

From the Board and Chief Executive

It is our pleasure to present the South Australian Superannuation Board Annual Report for 2023 24.

Super SA's funds under management as at 30 June 2024 was $37.6 billion and total number of members was 217,629.

120 years of putting members first

At Super SA we strive to deliver great outcomes for our members and 2023-24 was no exception.

In November 2023, Super SA celebrated 120 years of supporting members to live their best lives in retirement. We are exceptionally proud of this achievement which is testament to our enduring commitment to excellence, member focused service, and dedication to helping our members achieve financial security and well-being in their retirement years.

Superannuation and invalidity insurance play vital roles in our community. In 2023-24 we commenced a review to ensure our insurance offering, our products and the process for claiming, meet with member expectations.

Members have responded positively to Super SA's Limited Public Offer, which was introduced in November 2022 to give eligible members the ability to direct contributions from non-SA Government employers to Super SA Select. In the past financial year, we have seen an increase of 113% in the number of accounts in Super SA Select.

Super SA continues to have a strong local presence. Our Member Centre at the corner of Pirie and Pulteney Streets, serves as a convenient 'one stop shop' for our members. In the past financial year, we supported 18,491 members in person, a 41% increase on the previous year.

Our Financial Advice Administration team supported 523 members seeking advice with their retirement planning. Looking ahead, we are exploring additional ways to provide financial advice to even more members.

Member engagement and education remained top priorities for us to support members to better understand their superannuation investments and retirement planning. In 2023 24, we connected with 31,258 members through events, workplace visits and digital content, an increase of 26.7% on the previous year. This included hosting 49 in person seminars across various metropolitan suburbs and regional locations, and 105 live webinars.

Strategic direction

The Board's focus is on continued growth, sustainability and modernisationwith a vision to be the mosttrusted superannuation fund for current and former South Australian public sector employees.

The Board has developed its strategy in the spirit of the Australian Prudential Regulation Authority (APRA) Prudential Standard SPS 515 Strategic Planning and Member Outcomes, a standard which requires regulated superannuation funds to deliver demonstrable quality outcomes and act in the best financial interests of its members.

Super SA has adopted this important standard to serve the best financial interests of our members. We will continue to achieve this by:- Collaborating with our investment partner, Funds SA: to deliver strong investment outcomes for our members

- Designing competitive products: to meet the needs of both current and future members, through our superannuation and insurance product offerings

- Enhancing digital member capabilities: focusing on increasing member engagement while maintaining strict cybersecurity measures

- Delivering a member centric experience: continuing to foster a culture focused on the best interests of our members.

2024-25 Vision

In May 2024 the Board developed a new vision for the 2024 25 year; "To be the most trusted superannuation fund for current and former South Australian public servants".

Importantly, long-term performance remains positive with members benefitting from returns that generally exceed stated performance objectives for growth-based options, as at 30 June 2023.

Investment performance

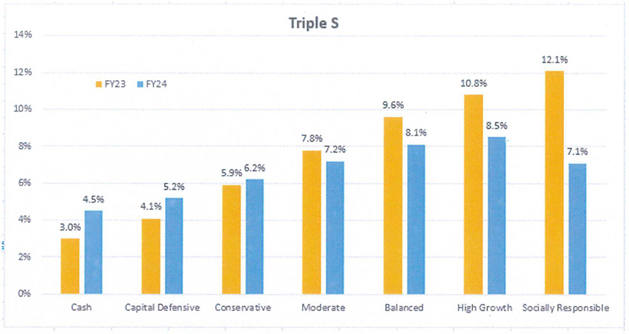

Global markets continued to be volatile over the year with a selection of technology companies driving more than half of the growth in the US stock market. Despite challenges, our investment partner Funds SA returned a positive 8.1% financial year return for members invested in the Triple S (untaxed) Balanced option.

Super SA continues to focus on positive, long-term performance underpinned by extensive knowledge and expertise. By continually focusing on long term investment strategies and results, rather than short term market fluctuations, our members can expect returns to consistently meet the investment objectives.

Thank you

To all our members, thank you for entrusting us as your superannuation provider. We appreciate and value your membership.

We also thank the Board and all Super SA staff for their continued dedication to members' best interests throughout the past 12 months.

Signed by:

June Roache, Presiding Member

Super SA BoardPatrick McAvaney, Acting Chief Executive

Super SA -

Contents

Overview: about the agency

Our strategic focus

Our organisational structure

Changes to the agency

Our Minister

Our Board (as at 30 June 2024)

Our Executive team

Legislation administered by the agency

Other related agencies (within the Minister's area/s of responsibility)

The agency’s performance

Performance at a glance

Agency specific objectives and performance

Corporate performance summary

Financial performance

Financial performance at a glance

Other financial information

Risk management

Risk and audit at a glance

Fraud detected in the agency

Strategies implemented to control and prevent fraud

Public interest disclosure

Reporting required under any other act or regulation

Public complaints

Number of public complaints reported

Additional metrics

Service improvements

Compliance statement

Appendix: Audited financial statements 2023-24

-

Overview: about the agency

Our strategic focus

Our Purpose

Our purpose is to champion the financial well-being of our members. The Board is responsible for1 the administration of:- Triple S

- Pension Scheme

- Lump Sum Scheme

- Income Stream

- Flexible Rollover Product

- SA Ambulance Service Superannuation Scheme.

Our Vision

To be the most respected superannuation fund

Dedication – we are members serving members, so we go the extra mile and always look for ways to do better

Our Values

Insight – our experience means we know our SA members, and we build on this knowledge to deliver the best outcomes

Integrity – our ethical principles are non-negotiable, and we act in our members’ best interests transparently and consistently

Our Functions, Objectives and Deliverables

Our strategy is to excel and improve member experience whilst being competitive on fees and returns.

High level strategic objectives:- Grow the combined funds under management of all Super SA related Schemes to $43.1 billion by 30 June 2024*

- Net investment returns comparative to Super SA’s six key competitors

- Fees – to be in the most cost-efficient quartile of funds while

delivering additional services to members

Our Strategy

Four strategic themes:- Member and Employer Engagement – to enhance the member experience to drive engagement, retention and growth

- Future Proofing – to transform the Fund for long-term sustainability

- Competitive Products – to design product / investment options that deliver to member expectations in a competitive environment

- Member Centric Culture – to engage and develop our people to deliver a continually improving member centric service.

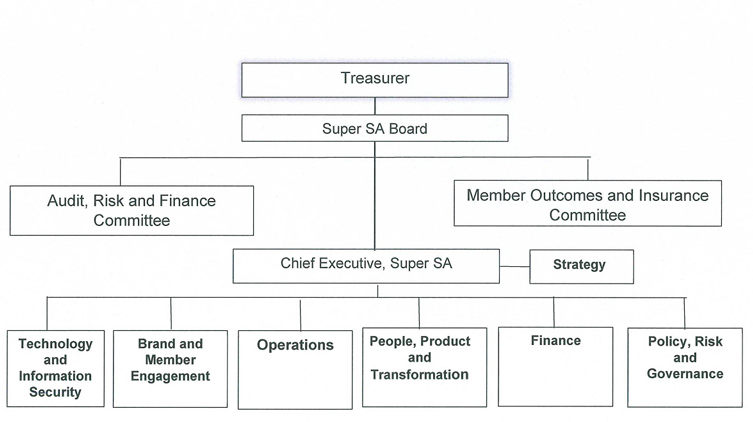

Our organisational structure

Changes to the agencyDuring 2023-24 there were no changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes.

Our Minister

The Hon. Stephen Mullighan MP is the Treasurer and the Minister responsible for superannuation.

Our Board (as at 30 June 2024)

June Roache

Presiding Member (Chair), appointed by the Governor from 27 July 2023.Extensive business experience, having held chief executive roles and several governance roles in South Australia, nationally and internationally. Her experience extends to commercial, health, sports, arts and regulatory and not for profit organisations.

Ms Roache has a Degree in Accounting from the University of SA, a Graduate Certificate in Management from Mt Eliza Business School and is a Fellow of the Australian Institute of Company Directors, CPA Australia and the Institute of Managers and Leaders.

She is currently Chair and a Director of Forestry SA and Presiding Member of the Southern Select Super Corporation.

Alison Kimber

Member representative elected from 2 October 2021 - 1 October 2024.Significant board and executive experience in financial markets, superannuation and community service delivery. More than 30 years’ experience in the finance, government, and not-for-profit sectors

Fellow of the Australian Institute of Company Directors and Fellow of the Institute of Actuaries of Australia.

Councillor, Australian Institute of Company Directors SA/NT and Board Member, Southern Select Super Corporation, Member, Cabaret Fringe Association Board, Member, ACT City Renewal Authority Board and Board member Can Do Group.

William Griggs

Member representative elected from 2 October 2021 - 1 October 2024.

Bill Griggs brings to the Board significant leadership and board experience, with expertise in corporate governance, people and culture, superannuation, investment, and insurance. He has a particular interest in managing/coping during times of uncertainty and in evidence-based decision making.

Current Directorships or equivalent - Director, Funds SA, Director, Return to Work SA, Board Member, Southern Select Super Corporation and Board member, St John Ambulance.

Fellow of Australian Institute of Company Directors.

Mr Richard DennisAppointed by the Governor from 23 July 2021 - 22 July 2024.

Richard Dennis is a legal practitioner and consultant and held the position of South Australian Parliamentary Counsel 2006-2015.

Director of the Order of Saint John of Jerusalem Knights Hospitaller Australasia and Board Member, Southern Select Super Corporation.

Rosina Hislop

Appointed by the Governor from 14 December 2023.An experienced board director and national facilitator with the Australian Institute of Company Directors. Ms Hislop serves on the boards of enterprises across health, education and aged care and Board Member of the Southern Select Super Corporation.

Independent director at Dr Jones & Partner Medical Imaging and chair of the risk and performance committee at the Department of Child Protection, chair of the governing council of the South Adelaide Local Health Network, chair of Seymour College and director of GPEx.

Attendance at Board and Committee meetings2

All members serve in a part-time capacity.

Board members attend a variety of national conferences and education seminars.

During the 2023-24 year, Board members attended the Association of Superannuation Funds of Australia Conference (Adelaide, November 2024).

Name

Board

Audit, Risk and Finance Committee

Member Outcomes and Insurance Committee

Eligible to attend

Attended

Eligible to attend

Attended

Eligible to attend

Attended

June Roache

11

11

2

33

Alison Kimber

12

11

3

3

1

1

Bill Griggs

12

11

-

13

1

1

Richard Dennis

12

10

5

4

Rosina Hislop

5

5

2

2

Our Executive TeamDini Soulio, Chief Executive

Responsible for leading the organisation and delivering on the Board’s strategic agenda whilst ensuring that Super SA meets legislative and reporting requirements for all superannuation funds managed.

Patrick McAvaney, Director Policy and Governance

Responsible for the provision of leadership and advice in the areas of legislation, policy, dispute resolution, risk management, compliance and governance practices across Super SA.

This role is also responsible for board and committee services.

Lorna Harrison, Director Operations

Responsible for leading the Operations team to ensure the timely and accurate collection of contributions and member data, payment of benefits, administration of post retirement services and the annual review process for the funds administered by Super SA.

In addition, the role leads the insurance delivery service.

Karen Raffen, Director Brand and Member Engagement

Responsible for leading the design and implementation of a contemporary brand, marketing and member experience strategy for the Fund.

Karen is responsible for the areas of member services, financial advice, marketing and member experience, strategic communications, stakeholder engagement and member education.

The role also develops business solutions that optimise the Board’s strategic objectives in relation to maintaining and improving scale through membership retention and growth.

Adrian De Silva, Director Strategy, Product and Transformation

Responsible for leading the People, Product and Transformation function across Super SA.

This includes accountability for the design and alignment of superannuation product offerings to meet member outcomes, while also supporting the relationship with our Investment Managers Funds SA.

The role’s responsibilities also include Super SA’s Project Management Office and Learning & Development and Human Resources functions.

Mike Gulliver, Director Technology and Information Security

Responsible for providing strategic and operational leadership to deliver technology and data services in support of Super SA’s strategy and ongoing benefit for members. This includes responsibility for IT application roadmap and solution delivery, data analytics and reporting, and member data protection practices aligned to government requirements and standards,

This role is also accountable for managing contractual IT service level agreements, budgets, and key relationships with agencies and external technology partners.

Mark Hordacre, Director Finance

Responsible for leading the Finance, Actuarial and Procurement group in the design and delivery of sound financial management services for the benefit of our members and relevant agencies.

This includes responsibility for the provision of financial and management accounting services to the Schemes and the Board, tax and investment operations for the Schemes.

Legislation administered by the agency

The Super SA Board is responsible to the Treasurer for all aspects of the administration of:- Southern State Superannuation Act 2009 (Triple S, Flexible Rollover Product and Income Stream); and

- Superannuation Act 1988 (Lump Sum and Pension Schemes) except for the management and investment of the funds.

The Board also acts as trustee of the SA Ambulance Service Superannuation Scheme and is responsible for administering the Trust Deed and rules.

The Government of South Australia, other state and territory governments and the Commonwealth Government have entered into a Heads of Government Agreement on superannuation (HOGA) that recognises certain public sector schemes are exempt public sector superannuation schemes and therefore exempt from the Commonwealth’s Superannuation Industry (Supervision) Act 1993 (SIS Act).

Each scheme is, however, deemed to be a complying fund in terms of the SIS Act, for superannuation guarantee purposes under the Superannuation Guarantee (Administration) Act 1992 and for income tax purposes under the Income Tax Assessment Act 1936.

In terms of the HOGA, the state government has made a commitment to use best endeavours to ensure that the exempt public sector schemes conform to the principles of the Commonwealth’s retirement income policy objectives.

Other related agencies (within the Minister's area/s of responsibility)

Super SA

On behalf of the Super SA Board, Super SA is responsible for managing SA Public Sector superannuation schemes in line with relevant governing legislation and instruments.

This arises from section 10(3) of the Superannuation Act 1988, which enables the Board to make use of the staff or facilities of an administrative unit of the SA Public Sector, with the approval of the Minister of that administrative unit. Super SA, a branch of the Department of Treasury and Finance, provides administrative services to the Board on this basis.

The Board's service level contract with the Under Treasurer sets out specific performance standards. A new contract commenced for a term of three years with effect from 1 July 2023.

The annual budget for the operation of Super SA is presented to the Board for its approval.

The use of consultants, contractors, Work, Health and Safety reporting and executive employment statistics are included in the Department of Treasury and Finance's Annual Report.

Funds SA

Funds are managed by a specialist investment manager, Superannuation Funds Management Corporation of South Australia (Funds SA). Funds SA manages the investments for each scheme in accordance with sections 17 and 19 of the Superannuation Act 1988, sections 10 and 11 of the Southern State Superannuation

Act 2009, and the provisions of the Superannuation Funds Management Corporation of South Australia Act 1995.

The current Memorandum of Agreement between Funds SA and Super SA was executed in February 2022. Funds SA provides this service under legislation. The agreement is reviewed on a three yearly basis or when a significant change occurs.

1 Super SA also provides administration services to other public sector superannuation funds, which are governed by other Boards and the Treasurer, i.e. Southern Select Super Corporation Board, Parliamentary Superannuation Scheme Board, Governors' Scheme Pension Fund and Judges' Scheme Pension Fund.

2 Board member participation in out of session decisions made by circular resolution as defined in the Board's regulations have also been included.

3 Board member can attend any committee meeting if they wish. -

The agency’s performance

Performance at a glance

Super SA’s performance is assessed continuously against key objectives at least every quarter. This will ensure the projects and initiatives conducted throughout the year are aligned to meet the key objectives.

Over the last financial year, Super SA has delivered on a number of multi-year initiatives that focus on improving the fund’s operating model and continue to enhance services to members:- Commenced the introduction (phase 1 of 2) of a contemporary unit pricing model

in line with Australian Securities and Investment Commission (ASIC) Regulatory

Guide 94 Unit Pricing: Guide to good practice. - Introduced a member experience framework to assist with member retention following the introduction of fund selection for public sector employees in 2022, which intends to further strengthen our member centric culture and practices across the business operations.

- Utilised a modern data and analytics platform to enhance decision making and member support. Data governance and data protection controls have been enhanced consistent with the SA Government Cyber Security Framework.

Super SA has aligned with the Australian Prudential Regulatory Authority (APRA) standards, where possible. The HOGA requires that Super SA use a best endeavours approach to do so. In striving to achieve this we have undertaken:

- Ongoing development of a SPS515 Strategic Planning and Member Outcomes framework for Super SA and implemented changes to budgeting, business planning and business case preparation

- Ongoing delivery of the Protecting Your Super program that addresses account erosion due to excessive fees

- An upgrade of the Super Stream Rollover upgrade to meet ATO requirements

- Continued development of a cyber security strategy in line with the SA Government's Cyber Security Framework.

Agency specific objectives and performance

2023-24

Actual2023-24

Target2022-23

Actual2022-23

Target2021-22

ActualAchievement of approved service level standards by 30 June each year

86%

84%

73%

90%

68%4

Benchmarking of administrative costs with industry standards4 — remain in the most cost- efficient quartile of industry standards* while providing additional services to members.

In the most cost- efficient quartile

In the most cost- efficient quartile

In the most cost- efficient quartile

In the most cost- efficient quartile

In the most cost- efficient quartile

*Based on last available Chant West Super Fund Fee Survey

Agency objectives

Indicators

Performance

Member and Employer Engagement – to enhance the member experience to drive engagement, activation and retention

Achievement of service level standards target 84%

Achieved

86%Complaints management

target <265 complaints per year

205

Education connections

target 20,000 membersAchieved

31,258Competitive Products

SuperRatings rating

Achieved

Triple S received Gold

Rating from SuperRatingsMember Centric Culture – To engage employees to deliver an efficient and member centric service Staff culture target 70%

Achieved

74%Corporate performance summary

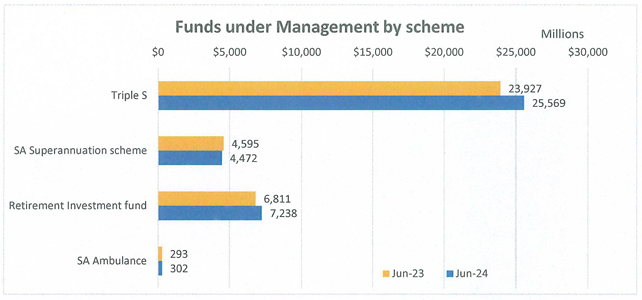

In measuring fund sustainability, Super SA monitors the funds under management by scheme.

Funds under management

The comparison of the 2024 and 2023 funds under management by scheme is shown in the graph below.

Investment returns for Triple SThe comparison of the 2024 and 2023 investment returns for Triple S over each investment option is shown in the graph below:

5 Service level standards were impacted across the organisation due to additional security measures applied due to the December 2021 SA Government Frontier data breach. - Commenced the introduction (phase 1 of 2) of a contemporary unit pricing model

-

Financial performance

Financial performance at a glance

The funds under management was $37.6 billion as at 30 June 2024. The total number of members as at 30 June 2024 was 217,629 which represents an increase of 2,311 members from the prior year. This figure comprises the following categories of members:

- Triple S active and preserved

- Pension Scheme superannuant, active and preserved

- Lump Sum Scheme active and preserved

- SA Ambulance Service Superannuation Scheme active and preserved

- Super SA Income Stream active, and

- Flexible Rollover Product active.

No. of contributors/ members in state schemes:

2023-24

Actual2024-25

ForecastMembers

217,629

217,607

- Triple S (total)

180,128

180,000

- Flexible Rollover Product

8,437

8,859

- Income Stream

13,912

14,329

- Superannuants

12,486

12,443

- Other retirement schemes (Pension, Lump Sum, SA Ambulance)5

2,328

1,976

Pension

158

109

Lump Sum

1,649

1,378

SA Ambulance

525

489

Triple S membership grew slightly by 1.2% compared with 2023-24. The other remaining open schemes also had small increases in membership. All closed schemes continued to decline in membership.

Below is a summary of the number of preserved members as at 30 June 2024 (preserved membership numbers as at 30 June 2023 is shown for comparison).

No. of preserved members in state schemes:

30 June 2023

30 June 2024

change

Members

52,248

49,910

(2,338)

Triple S (total)

51,346

49,130

(2,216)

Pension

114

89

(25)

Lump Sum

710

609

(101)

SA Ambulance

78

82

(4)

Other financial informationThe State Government has a strategy to fund both its accruing and accrued past service superannuation liabilities by 30 June 2034.

South Australian Superannuation Fund

Esther Conway, an actuary with Mercer Consulting (Australia) Pty Ltd, performed the actuarial review of the South Australian Superannuation Fund (Pension and Lump Sum Schemes) as at 30 June 2022, and the results are contained in a report dated 23 June 2023.

The review was performed to meet the requirements of section 21 of the Superannuation Act 1988, which stipulate actuarial reviews be undertaken every three years. This section of the Act requires the actuary to provide a report on the following aspects:- the cost of the scheme to the State Government at the time of the report and in the foreseeable future

- the proportion of future benefits under Part 5 of the Act that can be met from the Fund.

Triple S Insurance Pool

A triennial review of the Triple S Insurance Pool as at 30 June 2022 was performed by Nathan Bonarius, an actuary with PricewaterhouseCoopers (PwC).

This report was prepared in accordance with the requirements of section 17 of the Southern State Superannuation Act 2009.

The report assesses:

• the cost and funding of insurance benefits provided through the scheme as at 30 June 2022

• the extent to which the premiums paid by members and held by the Board are sufficient to meet the scheme's anticipated liabilities at 30 June 2022 and in the foreseeable future.

The next actuarial review of the Triple S Insurance Pool is due to be performed as at 30 June 2025.SA Ambulance Service Superannuation Scheme

Esther Conway, an actuary acting on behalf of Mercer Consulting (Australia) Pty Ltd, performed the actuarial review as at 30 June 2023 to meet the requirements of the scheme's governing rules, which stipulate that actuarial reviews are to be undertaken every three years.

The next actuarial review of the SA Ambulance Superannuation Scheme is due to be

performed as at 30 June 2026.Full audited financial statements for 2023-2024 are attached to this report.

5 Comprises both active and preserved members.

-

Risk management

Risk and audit at a glance

The Super SA Governance and Risk team’s responsibilities include oversight of risk management, compliance, the Board’s anti-money laundering and counter-terrorism financing program, incident management and business continuity management. The team also manage internal audit reviews conducted by an external provider.

Fraud detected in the agency

Category/nature of fraud

Number of instances

Financial Impact to Super SA ($)

Fraudulent transactions attempted by external parties on member accounts

3

NIL

Applications for unauthorised early release of superannuation on compassionate grounds NIL

NIL

NB: Fraud reported includes actual and reasonably suspected incidents of fraud.

Strategies implemented to control and prevent fraud

To ensure a strong control environment exists to prevent the occurrence of fraud, the Super SA office has implemented strong monitoring and validation controls over benefit payments, including verification with members of large benefit payment requests, system-based identification of unusual member account activity, validation of proof of identity prior to payment and independent review and authorisation of all benefit payments.

Regular information is provided to the Super SA Board from internal and external audit, the Audit, Risk and Finance Committee and the Chief Executive.

Super SA maintains the Board’s Risk Management Strategy and Plan; a Business Continuity Framework and Plan; an Internal Audit Plan; a Compliance Framework and an Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Program.

Data for previous years is available here.

Public interest disclosure

Numberof occasions on which public interestinformation has been disclosed to a responsible officer ofthe agency under the Public Interest Disclosure Act2018: NIL.6

Data for previous years is available here.

Reporting required under any other act or regulation

Act or Regulation

Requirement

Section 29(1) - Southern State Superannuation Act 2009

The Board may give such directions as are reasonably necessary to resolve a doubt or difficulty that arises under the Act/regulations or circumstances that has arisen that are not addressed under the Act/regulations and any such direction will have effect according to its terms. If the Board gives such a direction, the Board’s report to the Minister in the financial year in which the action is taken must include details of the action.

Details to be reported: 3

Due to insufficient prior notice to three members of the cancellation of insurance as a result of insufficient premiums, the Board directed their insurance be reinstated under the same terms and conditions as before the cancellation.Section 29(2)(a) - Southern State Superannuation Act 2009

If, in the opinion of the Board, a time limit under this Act or the regulations should be extended in particular circumstances, the Board may extend the time limit (even if it has already expired). If the Board extends a time limit, the Board’s report to the Minister in the financial year in which the action is taken must include details of the action.

Details to be reported: 56 (with further details of applicable extended time limits set out below):Applicable legislative reference Number of times the power to extend the time limit was exercised Section 25(1a)

The time limit by which a member must request a review by the Super SA Board of a decision (within 3 months of receiving notice of the decision)

2

Reg 36AA(1)

The time limit by which a member must apply for income protection benefits (within 6 months of first absence from work, or within 6 months of ceasing workers compensation/leave)32

Reg 48(8) & (9)

The time limit by which a Triple S member/spouse member is required to invest in the Flexible Rollover Product and continue death and Total and Permanent Disablement (TPD) insurance (60 days)

21

Reg 6(4)(a)(i)(C) & 58(12)

The time limit by which a member must lodge a TPD claim (2 years from termination of employment)

1

Section 29(2)(b) - Southern State Superannuation Act 2009

If, in the opinion of the Board, a procedural step under this Act or the regulations should be waived in particular circumstances, the Board may waive compliance with the procedural step. If the Board waives a procedural step, the Board’s report to the Minister in the financial year in which the action is taken must include details of the action.

Details to be reported: 3

The Board waived the procedural step of applying for cover for three members, following the cancellation of their cover (due to insufficient premiums), given they were not provided with sufficient notice of the

impending cancellation (with further details of applicable waiver of procedural steps set out below):Applicable legislative reference Number of times the power to waive a procedural step was exercised

Reg 37(4) and 37A

Waiver of procedural step to apply for income protection insurance in certain circumstances.

3

Schedule 3, section 10 Superannuation Act 1988

Super SA must, in conjunction with each annual report of the Board under this Act, provide a report on the operation of this Schedule in relation to any administered scheme that is within the ambit of a declaration under clause 2(1)(b) during the financial year to which the annual report relates.

The report must include—

a) a copy of any accounts or financial statements that are required to be audited under this Schedule in respect of each relevant scheme for the financial year; and

b) if a fund has been managed under Part 3 Division 1 in respect of any part of the relevant financial year—a copy of the audited accounts and financial statements for that fund provided by the Superannuation Funds Management Corporation of South Australia.

Details to be reported: The report on the operation of the SA Ambulance Service Superannuation Scheme and requisite financial statements is included within this annual report.Superannuation (Unclaimed Money and Lost Members) Act 1999 (Cwth) Pursuant to this legislation, prescribed exempt public sector superannuation schemes are permitted, rather than required, to transfer amounts to the ATO. A number of Super SA Schemes are prescribed within the Commonwealth legislation and the Super SA Board has set policies in relation to which unclaimed money, lost members and inactive low balance accounts are to be transferred to the ATO.

Unclaimed Money

(Part 3, Section 18AA)Triple S accounts were transferred to the ATO on 27 and 28 October 2023 (30 June 2023 reporting) and 26 April 2024 (31 December 2023 reporting) a total of $4,559,317.89 covering 264 members

Lost Accounts

(Part 4A section 24HA)Triple S accounts were transferred to the ATO on 27 and 28 October 2023 (30 June 2023 reporting) and 27 April 2024 (31 December 2023 reporting) a total of $137,807.60 covering 124 members

Inactive Low Balance Accounts

(Part 3B, section 20QH)Triple S accounts were transferred to the ATO on 27 October 2023 (30 June 2023 reporting) and 27 April 2024 (31 December 2023 reporting) for a total of$2,806,468.82 covering 2,485 members

Deceased Triple S accounts were transferred to the ATO on 27 October 2023 (30 June 2023 reporting) and 27 April 2024 (31 December 2023 reporting) for a total of$4,084,721.42 covering 397 members

Public complaints

Number of public complaints reported

Complaint categories

Sub-categories

Example

Number of Complaints

2022-23Professional behaviour

Staff attitude

Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency

4

Professional behaviour

Staff competency

Failure to action service request; poorly informed decisions; incorrect or incomplete service provided

0

Professional behaviour

Staff knowledge

Lack of service specific knowledge; incomplete or out-of-date knowledge

2

Communication

Communication quality

Inadequate, delayed or absent communication with customer

22

Communication

Confidentiality

Customer’s confidentiality or privacy not respected; information shared incorrectly

3

Service delivery

Systems/technology

System offline; inaccessible to customer; incorrect result/information provided; poor system design

13

Service delivery

Access to services

Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities

0

Service delivery

Process

Processing error; incorrect process used; delay in processing application; process not customer responsive

119

Policy

Policy application

Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given

6

Policy

Policy content

Policy content difficult to understand; policy unreasonable or disadvantages customer

30

Service quality

Information

Incorrect, incomplete, outdated or inadequate information; not fit for purpose

4

Service quality

Access to information

Information difficult to understand, hard to find or difficult to use; not plain English

0

Service quality

Timeliness

Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met

0

Service quality

Safety

Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness

0

Service quality

Service responsiveness

Service design doesn’t meet customer needs; poor service fit with customer expectations

0

No case to answer

No case to answer

Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate

0

Investments

Investments

Investment fees; Dissatisfaction with investment of assets

0

Total

203

Data for previous years is available here.Additional metrics

Total

Number of positive feedback comments

32

Number of negative feedback comments

25

Total number of feedback comments

165

% Complaints resolved within policy timeframes

82%

within 45 days

(responses to complaints received

in the 2023 2024 financial year)

Service improvements

- The Board set a key performance indicator to keep complaint numbers below 265 in the 2023 24 financial year. This target was surpassed with 203 complaints received, being a significant improvement on last year's numbers.

- Following the implementation of the new Dispute Resolution process in 2022-23, an initiative was launched in 2023 24 to perform regular quality assurance checks. This initiative aims to further improve complaints handling and ensure that outcomes are fair and reasonable.

- Enhancements were made to the Super SA website to make it easier for our members to submit a complaint and to understand their internal and external appeal rights.

- The Appeals Management Procedure was updated to formalise and streamline the process for independent internal reviews, resulting in improved member outcomes and reduced waiting times.

- All Super SA Branch Procedures and Rules were updated and registered in a centrally located and easily accessible location for all staff access.

- To enhance member response times, Board delegations were expanded to empower office delegates to address more requests for extensions of time to transfer Triple S insurance to the Flexible Rollover Product, in respect of such requests lodged outside of the maximum lodgement period. A streamlined process was also implemented for those requests requiring consideration of the Board.

- The governing legislation for Triple S was amended effective 30 November 2023, to enable mandatory contributions for prescribed SA Ambulance Triple S members to be made by salary sacrifice, when they were previously only permitted to be made as an after-tax contribution.

- Member facing communications were enhanced, including:

-

-

-

- some forms and fact sheets were combined to reduce the volume of

publications and make them easier for members to locate on the website; - revised the wording in the Flexible Rollover Product disclosure statement

to clarify the cooling off provisions and the rules around the conditions of

release when exercising cooling off; - enhanced communications on the tax implications for members over age

65 claiming a cash payment directly from Triple S; - updateswere madeto communications for members redirecting employer

contributions to Triple S, clarifying that a new account is created and

detailing the applicable rules.

- some forms and fact sheets were combined to reduce the volume of

-

-

-

- Training was provided to member facing staff on the process undertaken upon the death of a Pension Scheme member, in order to improve communications to spouses and executors around processes and the expected time frames.

- Super SA staff also participated in various training sessions focused on

communications, empathy, and resilience.

Compliance statement

Super SA is compliant with Premier and Cabinet Circular 039 – Complaint Management in the South Australian Public Sector (PC039)

Y

Super SA has communicated the content of PC 039 and the agency’s related complaints policies and procedures to employees

Y

The Super SA Board has its own complaints policy, based on the timelines and processes adopted by the superannuation industry.

6 Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1/7/2019.

-

Appendix: Audited financial statements 2023-24